On 4 December 2025, I executed a short trade on XRP after spotting a textbook double top reversal pattern. The result? A clean +9.77% profit using 5× leverage in just one trading session.

However, this trade also highlighted the challenge of manual trading — I had to close early due to real-life obligations. While I captured profit, I missed an extra 10–15% because I couldn’t monitor the charts 24/7.

This post breaks down the trade, the reasoning, lessons learned, and why automation via AlgoColony can help capture these opportunities stress-free.

Key notes

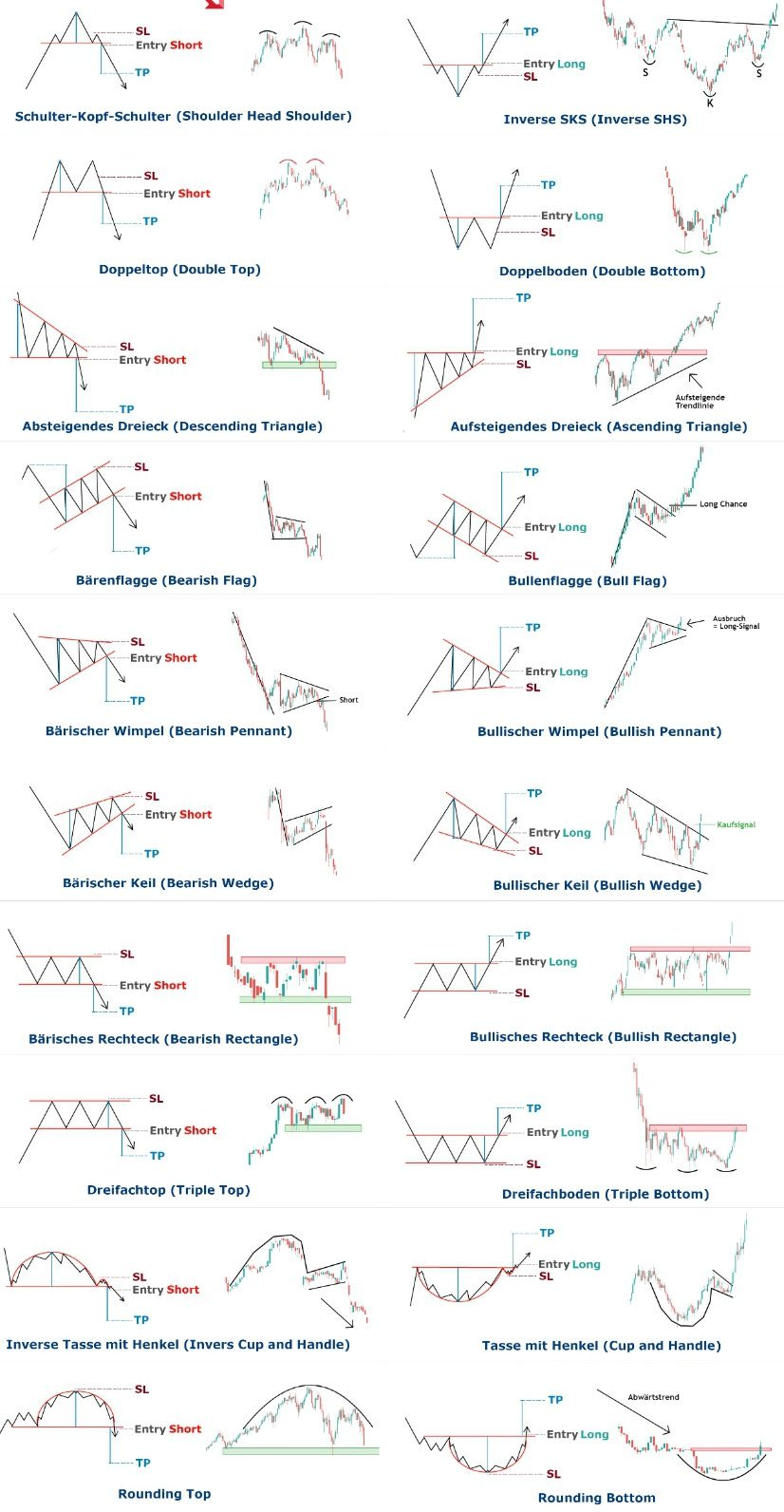

- Identifying a Double Top pattern on XRP

- Entry and exit levels with exact prices and leverage used

- Trade outcome: Profit secured, but missed potential extra gains

- Managing emotions and sticking to a personal risk rule

- Time-commitment challenge of manual trading

- Screenshots showing chart setup & price action

- Takeaways for future trades and AlgoColony strategy automation

The Setup: Spotting the Double Top

I entered short after identifying a classic double top reversal pattern — price pushed up, tested resistance twice, and failed to break higher. When the second top failed, price broke the neckline, confirming the bearish trend.

(Learn more about Double Tops: Corporate Finance Institute)

(Broader explanation: Finance Strategists)

➡️ Entry Price: 2.1781 USDT

➡️ Exit Price: 2.1356 USDT

➡️ Leverage: 5×

➡️ Capital Used: ~30% of account

➡️ Trade Duration: ~8 hours (09:00 → 17:00 UTC+2)

➡️ Take Profit Target: Fibonacci 1.272 extension

This pattern isn’t only for stocks — it applies across crypto, forex and more.

(Broader explanation: Finance Strategists)

The Execution: Why I Took Profit Early

My trade reached my take profit level — great win. But here’s the part every trader knows too well…

The move continued further after I closed.

Had I stayed in, the trade could have been ~20% more profitable.

So why not ride the wave? Because I follow one simple personal rule:

If I open a position manually, I do not leave the screen.

If I can’t monitor it — I exit.

I had obligations coming up and I refuse to stress about an open trade. Profit protected is better than hope-based holding.

🧠 Emotions, Discipline & Time Commitment

Manual trading demands your time, attention, and emotional control.

Yesterday reminded me:

- I made the right decision based on my rule

- FOMO must never replace discipline

- Real life doesn’t stop just because you have a position open

Would more profit have been nice? Sure.

But regret doesn’t pay — profits do.

🤖 Why Automation Wins This Battle

Trades like this are exactly why AlgoColony exists.

With automated systems:

- The strategy would execute the setup without me watching the chart all day

- Emotional decisions get eliminated

- I can secure better trade management with predefined rules

- No panic-closing or distraction-based exits

This wasn’t a loss — it was a reminder of the opportunity cost of manual trading.

If you want to explore more about how discipline and patience matter in trading — check out my previous post: [Patience in Trading: The Difference Between Making Money and Building Wealth].

📌 Key Takeaways

- Repeatable setups: Patterns like Double Top can be codified in bots

- Stick to your rules: Consistency beats luck

- Profit is profit: Avoid chasing extra gains out of FOMO

- Manual trading is time-consuming: Automation provides freedom

🔮 What’s Next for XRP

1️⃣ Breaks new lower low → Short continuation

- Enter smaller position (~10% capital) for safer exposure

2️⃣ Fails to break lower low and forms higher high → Breakout long

- Enter on breakout momentum

🏁 Final Thought

A win is still a win — and this trade reinforces the purpose of what I’m building. Soon, strategies like this one will run automatically, even when I’m offline.

Next time: same setup, no stress — just results.

More trade breakdowns coming soon. 🚀

🔗 References & Further Reading

Patience in Trading – AlgoColony

Corporate Finance Institute: Double Top Pattern

Are trading bots legal?

Yes — trading bots are generally legal in most countries, including South Africa, as long as they operate on regulated exchanges and comply with local financial laws. However, legality can vary depending on your jurisdiction, so it’s important to check the rules in your country. What matters is how you use them — using bots for fraud, market manipulation, or unauthorized trading is illegal everywhere.

Can beginners use trading bots?

Absolutely. Platforms like AlgoColony offer paper trading on live data, allowing beginners to test strategies without risking real capital. Backtesting is useful, but live paper trading better simulates real market conditions.

How much capital do I need to start trading crypto or using bots?

You can start with as little as $100–$500, but realistic profits, like $100/day, usually require larger capital ($5,000+). Consistent compounding of small gains is key to growing your account safely.

Do trading bots guarantee profits?

No. Bots follow rules consistently, but profitability depends on the quality of your strategy, market conditions, and risk management. They are tools to execute your plan, not magic money machines.

Do chart patterns like double tops really work?

Yes — when used with proper risk management and rules. Double tops are a classic bearish reversal pattern. Combining them with stop-losses, take-profit levels, and proper position sizing improves their reliability.

(Learn more: Corporate Finance Institute)

Can bots adapt in volatile or sideways markets?

Yes, if your rules account for different market conditions. Trend-following bots may struggle in sideways markets, but mean-reversion or breakout strategies can thrive. Flexibility and testing are essential for consistent results.

Disclaimer: This content is for educational and informational purposes only. It is not financial advice. Always do your own research and make investment decisions based on your own circumstances.

Chart pattern cheat sheet