Over the past development cycle, I’ve been focused on laying down the core building blocks of the AlgoColony trading platform, with a strong emphasis on a secure broker setup and a no-code rule builder designed for real-world algorithmic trading. The goal at this stage is simple: create a safe, easy-to-use, no‑code foundation that both early adopters and non‑technical traders can grow into with confidence.

This post is a transparent look at what’s been completed so far, what’s actively being worked on, and how early users can help shape the platform during this phase.

Alo have a look at How A Simple Trading Bot Evolved Into A Powerful No-Code Platform for where it all started.

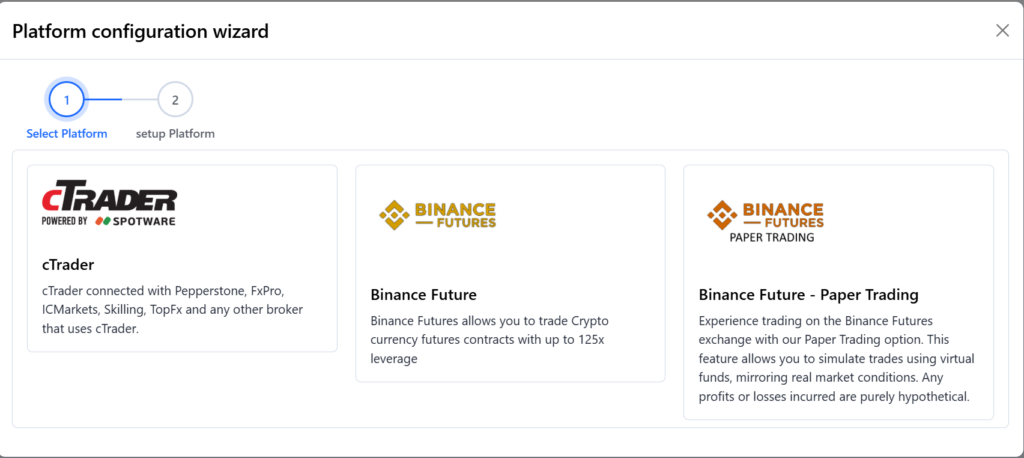

Broker Setup Wizard (Binance Futures & Paper Trading)

One of the first major milestones completed is the broker configuration wizard.

AlgoColony now supports:

- Binance Futures API

- Binance Paper Trading (for safe testing and experimentation)

The wizard is designed to make broker setup feel simple and guided, even for users who have never worked with trading APIs before.

What the wizard currently supports

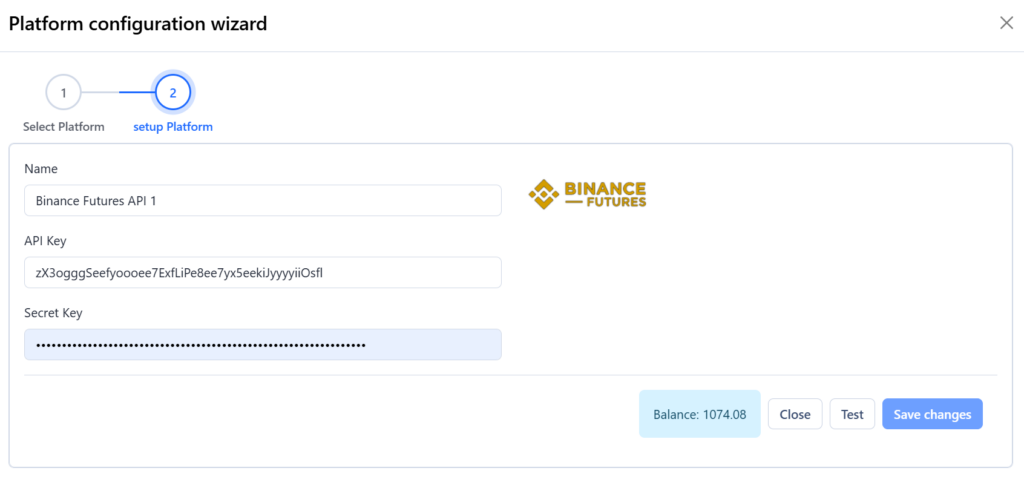

- Securely adding your Binance API credentials

- Testing API connectivity during setup

- Fetching and displaying your current account balance

- Preparing the account for use with bots and strategies

At this stage, Futures trading is supported. Spot trading will be added later as the platform evolves.

Step one: Select the prefered platform

Step two: Configure the platform. Click the test button to get the current balance. This will also enable the save button.

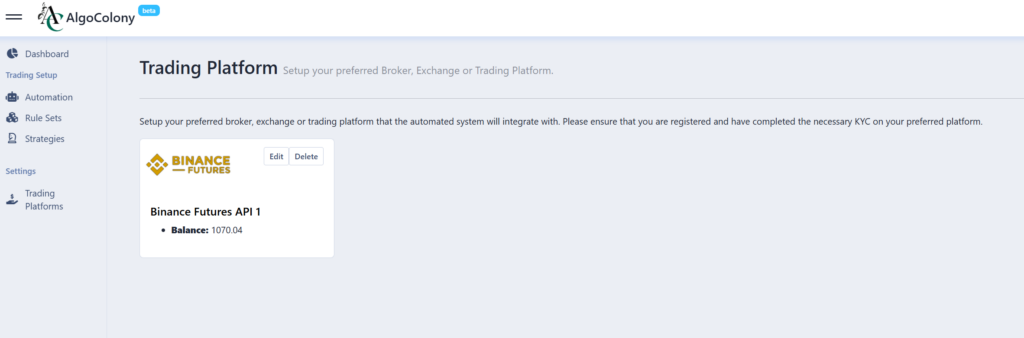

After setup, the list of current configured platforms will be refreshed, with the latest balance.

Broker selection and live vs paper trading toggles will be handled later in the bot configuration flow, where strategies and rules are assigned.

Security first

Security is not an afterthought — it’s foundational.

- API secret keys are encrypted before being saved to the database

- Keys cannot be viewed, reused, or shared, even internally

- Each API key combination is unique to a single user

- Withdrawals must be disabled when creating your Binance API key

AlgoColony will never initiate withdrawals, and there is no reason for withdrawal permissions to ever be enabled.

Rule Builder (No‑Code, Visual, Reusable)

The second major area of progress is the Rule Builder, built using Blockly.

This is a no‑code, visual rule set builder designed to let users define trading logic without writing scripts or code.

What is a rule?

A rule is a logical condition that evaluates market data.

Examples:

RSI > 75Candle Close > Candle OpenEMA crosses above MA

Rules can include:

- Comparisons

- Crossovers / cross‑unders

- Mathematical operations (add, subtract, multiply, divide)

- Multiple chained conditions

All rules are built visually using blocks — no syntax, no scripts, no hidden logic.

Shared and reusable by design

Rules in AlgoColony are shared building blocks.

- A rule is created once

- The same rule can later be reused across multiple strategies

- This avoids duplication and keeps logic consistent

At this stage, the platform focuses purely on rule creation.

The Strategy Builder — where rules are connected into flow charts with actions like executing trades or sending notifications — is currently under active development and will be covered in a future update.

Rule Builder in Action (Video Demo)

To make this more concrete, I’ve added a short 1‑minute video demo showing how a real trading rule is created using the Rule Builder.

In the video, I build a common trend‑pullback rule used by many traders:

- EMA (20) > EMA (50) — confirms an upward trend

- RSI < 40 — confirms a pullback within that trend

The rule is created visually using blocks and an AND condition, with no code or scripting involved. This demonstrates how practical trading logic can be expressed clearly and reused later when building full strategies.

This rule is not a strategy on its own — it’s a reusable building block that will later be plugged into the Strategy Builder.

Supported Indicators (Initial Set)

The Rule Builder currently supports the following indicators:

- RSI – Relative Strength Index

- MA – Moving Average

- EMA – Exponential Moving Average

- Candle – Candle-based conditions (open, close, high, low)

- ZigZag – Trend and swing identification

- Fibonacci Retracement – Key retracement level detection

This is an initial foundation, not a final list.

A closer look: ZigZag & Fibonacci

Two indicators worth highlighting are ZigZag and Fibonacci Retracement.

Within AlgoColony, these are designed to work as logic-driven tools, not just visual chart overlays:

- ZigZag helps identify meaningful price swings and trend structure, filtering out market noise

- Fibonacci Retracement allows rules to react to price behavior around key retracement levels

These indicators are integrated directly into the rule logic, making them usable in conditions rather than just charts.

More indicators will be added as development continues.

What’s Next

Development is moving in layers. The next focus areas include:

- More indicators (based on user demand)

- Strategy Builder – visual flow charts that connect rules to actions

- Bot configuration – assigning strategies, brokers, and execution settings

- Back testing – validating strategies against historical data

Each layer builds on the previous one to keep the system flexible, reusable, and easy to understand.

Help Shape the Platform

AlgoColony is still in an active development cycle, and early feedback matters.

If there are:

- Indicators you rely on

- Rule logic you’d like supported

- Ideas that would improve usability

I’d love to hear from you.

📩 Email: [email protected]

🐦 X / Twitter: @AlgoColony

📘 Facebook: @AlgoColony

This is the stage where user input has the biggest impact — and it helps ensure the platform grows in the right direction.

More updates coming soon.