AlgoColony wasn’t born from a grand plan — it started as a weekend project to automate one RSI strategy. But like many projects, one small idea turned into something much bigger: a full no-code trading automation platform.

Where It All Began

Back in 2019, before the world shifted with COVID-19, my investment journey looked very different. I had just ventured into farming, buying sheep with a vision for long-term growth. The logic was simple: livestock multiplies. If I started with 20 sheep, added 20 more each year, and let them breed, the return on investment would compound over time.

As a general rule of thumb, each ewe produces about 3 lambs over 2 years. So with a five-year plan, the math looked promising:

- Year 1: 20 sheep

- Year 2: +20 = 40 sheep → ~60 lambs over 2 years

- Year 3: +20 = 60 sheep → ~90 lambs

- Year 4: +20 = 80 sheep → ~120 lambs

- Year 5: +20 = 100 sheep → ~150 lambs

In theory, I’d have a thriving herd of over 250 animals by year five. But reality had other plans.

As any farmer will tell you, agriculture is unpredictable. Lambs don’t always survive, and adult sheep face their own risks. Despite the potential, after three years my herd stayed roughly the same—new lambs simply replaced those that didn’t make it. The model demanded more research, skill, and daily effort than I had anticipated.

And then came the unexpected: the price of sheep jumped, making it harder to add 20 each year. Life threw curveballs—time constraints, shifting priorities, and global disruptions. Without consistent reinvestment, the growth stalled.

That’s when I began exploring cryptocurrency and stumbled into the world of algorithmic trading for beginners. I looked at XRP (Ripple) and realized something profound: if I had invested the same amount into XRP instead of livestock, my portfolio could have more than doubled—with far less hands-on management. No feeding schedules, no breeding plans, no weather risks.

That moment sparked a shift in mindset and led me down the path of automated trading strategies like Dollar Cost Averaging. Unlike farming, trading offered a way to build systems that worked while I slept, adapted to market conditions, and didn’t require me to be physically present. Even without adding more capital each year, the potential for growth remained—thanks to compounding returns and smart automation.

Discovering Algorithmic Trading: Automate Everything

As I dove deeper into the crypto markets, one thing became obvious—prices fluctuate wildly throughout the year. The opportunity to buy low and sell high was there, but I had a major constraint: I was a full-time software developer. I couldn’t spend hours glued to charts, reacting to every price movement.

The solution? Automate everything.

I built my first spot trading bot, hardcoding rules to buy and sell based on price action. It worked… for a while. The bot made profits in the early days, but then it would stall—sometimes waiting weeks to close a trade. Without stop losses or dynamic logic, some positions got trapped in long downtrends.

That experience taught me a key lesson for anyone exploring algorithmic trading for beginners: automation is powerful, but it needs flexibility. Static bots aren’t enough. I needed smarter tools—something that could evolve with the market and adapt to changing conditions.

The Turning Point: Learning From Others

At a braai (barbecue) with friends, I mentioned my bot project. One of my friends, an experienced FX trader, gave me a game-changing tip: start using technical indicators like RSI, and read “Naked Forex: High-Probability Techniques for Trading Without Indicators“. That advice opened a new chapter in my journey.

I began integrating indicators into my bot, along with take profit and stop loss levels. The strategy improved. Trades became more structured, and the bot made smarter decisions. But something still wasn’t right.

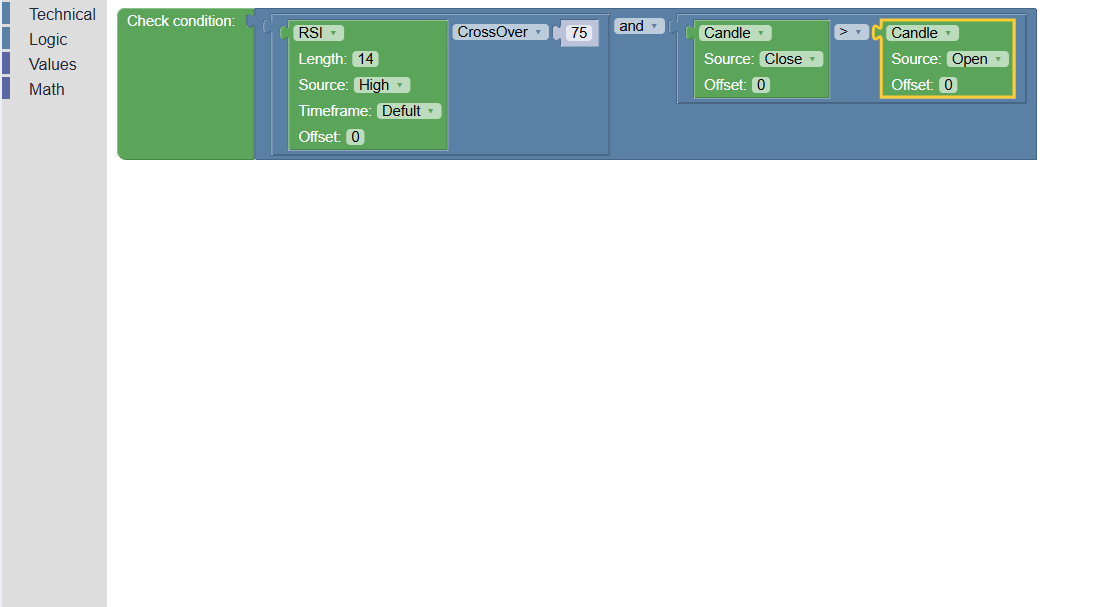

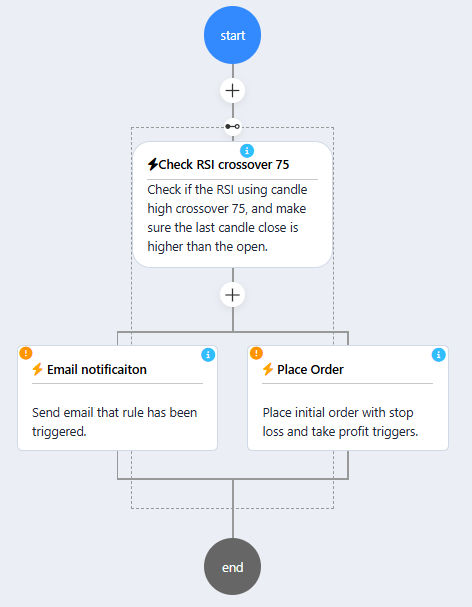

Every time I wanted to tweak a rule—whether adjusting an RSI threshold or changing a profit target—I had to dive back into the code, recompile, and redeploy. It was tedious and time-consuming. I realized that for automated trading strategies to truly work, I needed a way to dynamically adjust trading rules without touching code.

That’s when the idea of no-code trading bots started to take shape.

The First Step Toward No-Code Trading: Smarter Alerts

Around the same time, I ran into another challenge: price alerts weren’t enough.

Most traders rely on simple alerts, but setting them up manually was tedious and limited. More advanced strategies—like Fibonacci retracements—required adaptive alerts that could shift dynamically with market conditions. Static notifications just didn’t cut it.

To solve this, I built a local alert bot that would beep whenever it was time to check the charts. It was a small win for automation, but it came with big limitations:

✔️ I had to be at my PC to hear the alert

✔️ I missed opportunities whenever I stepped away

✔️ I needed cloud-based trading alerts that worked in real time

That’s when I began exploring cloud-based automation—a move that laid the foundation for what would eventually become AlgoColony, a platform designed to bring no-code trading alerts and flexible automation to traders of all levels.

Smart Price Alerts: The Next Evolution

Before I could even think about building no-code strategy builders, I had to solve a more immediate problem: alerts.

My local bot helped—it would beep when it was time to check the charts, letting me stay productive without being glued to the screen. But there was a catch: I wasn’t always at my PC. Some of the best trade setups slipped by simply because I wasn’t there to hear the beep.

That limitation pushed me to explore cloud-based trading alerts. By shifting to real-time notifications via email and other channels, I could stay informed no matter where I was. Instead of obsessively checking charts, I could rely on smart trading alerts that told me exactly when action was needed.

For anyone diving into algorithmic trading for beginners, this was a game-changer—automation wasn’t just about executing trades, it was about reclaiming time and focus.

From Local Bots to AlgoColony: Building a No-Code Future

Every step of this journey revealed a core truth:

- Trading automation is powerful—but only when it’s flexible

- Manual alerts and rigid bots aren’t enough for serious traders

- No-code rule building is the future of algorithmic trading

These insights led to the creation of AlgoColony—a cloud-based, no-code automated trading platform designed to help users build and customize strategies without writing a single line of code. Whether you’re looking to fully automate your trades or receive intelligent alerts, AlgoColony provides the tools to maximize efficiency, reduce emotional decision-making, and grow your investments with confidence.

It’s built for everyone—from those just starting with algorithmic trading for beginners to experienced traders seeking more control, adaptability, and scalability.

While exploring other trading bots and platforms, I noticed a recurring problem: high upfront costs and limited market compatibility. Many systems required expensive packages just to get started, and often didn’t support the assets or brokers I wanted to trade with.

That’s why I built AlgoColony differently.

By leveraging API integrations with major brokers (Like Binance and Pepperstone), AlgoColony allows users to connect directly to their existing accounts—without transferring funds or locking capital into a third-party system. Your wallet stays with your broker, and you stay in control. No KYC from our side.

Most importantly, I wanted AlgoColony to be accessible to everyday investors, not just high-net-worth individuals. That’s why the platform supports small trades starting from just $5, making it ideal for beginners, cautious investors, or anyone testing new strategies without risking large sums.

Why “AlgoColony”?

The name AlgoColony represents more than just a platform—it’s a philosophy.

Just as ants in a colony collaborate to build, adapt, and thrive, AlgoColony is a space where traders and bots work together in harmony. It’s about structure, efficiency, and evolution. The platform enables users to create, refine, and optimize trading strategies in a way that’s both powerful and approachable.

But it’s not just about the bots.

AlgoColony is also about community. No one succeeds in trading alone. That’s why we’re building a collaborative environment where traders can share ideas, learn from each other, and grow together. With a strong community and powerful tools, anything is possible when working together.

What’s Next?

AlgoColony is just getting started.

In the coming months, we’ll continue to expand the platform—adding more integrations, supporting additional markets, and refining the no-code algorithmic trading experience. We’re also launching frequent blog posts covering trading strategies, market insights, and everyday finance to help you stay ahead of the curve.

🚀 Join the Colony. Build your strategy. Let the bots work for you.

Keep up with our progress by viewing the latest posts Inside the Colony